Tower Properties – Valuable Real Estate Holdings

Summary

This real estate holding company is trading at an attractive valuation with a significant margin of safety.

The conservative valuation scenario matches the market cap. This scenario heavily discounts the stable cash flow the company is able to receive from its properties. Thus, TPRP should trade higher.

A reasonable valuation scenario values the asset base at around $25,000 per share, or a 51% upside, but even this still does not fully account for the cash flow.

Thus, ‘going concern’ upside could be significantly larger, and investors should benefit from accumulating shares at current prices.

The main issue is unlocking that value as TPRP is a family-controlled business, but I would not say that this diminishes the value rather that it makes it a long-term investment.

Investment Thesis

I believe that Tower Properties (OTCPK:TPRP) should be on every investor’s watch list, and if the opportunity arises (due to scarce liquidity), they should buy the shares due to the following points:

- The company owns a significant amount of real estate predominantly located around Kansas City in Missouri, which is carried on the balance sheet at overly depreciated amounts. TPRP owns several office buildings and multi-family complexes around the area, some of which have been bought in the early 1990s and 2000s. All of the real estate properties are situated in attractive areas, almost fully occupied and are well maintained, which makes the current valuation unreasonable. A simple conservative scenario (mainly using historical costs of the buildings) shows that the value currently matches the market cap, while a more nuanced approach based on various market estimates places a 51% upside on the stock. Either way, this shows that the margin of safety is significant and that the shares should trade higher.

- Further upside is also present in the cash flow stream of the business as the company is well managed and is able to currently rake in approximately $9 million of ‘free’ cash flow per annum (including CapEx). This number is also likely to meaningfully increase this year as the company finished refurbishing one major office property and finished constructing a smaller multi-family project. While they scarcely pay the cash flow out to the shareholders, it certainly helps the balance sheet as they pay down the mortgages with it and acquire new properties.

That being said, there are several challenges for seeing this upside realizing:

- Most importantly, the company is controlled by Kemper family that owns a significant amount of shares (likely more than 66% as per last available data point). Its intentions are probably to slowly but surely buy out all of the minority shareholders and thus take the company private at possibly ‘low-balled’ price. The way it is doing it, though, does not seem to be hurting the upside as it generally repurchases shares from shareholders that are willing to sell. The family also runs a publicly listed community bank, Commerce Bancshares (CBSH), which could possibly present conflicts of interests, but the past dealings do not support this, and the family generally seems shareholder-friendly.

- The liquidity of the stock also presents an issue as in 2016 only a handful of shares were traded. While this makes it hard to accumulate, I don’t believe that it would necessarily make it too hard to sell given the point above.

- Lastly, the company is somewhat concentrated regarding the real estate. While the asset base currently creates a strong margin of safety and almost completely minimizes downside, should Kansas City or Missouri suffer an economic downturn, it could hurt the value of the company. That being said, the operational results throughout the crisis were stable (and the Kansas City market also rebounded since then). Thus, I don’t believe that the company would be unable to recover unless an outsized and permanent event hits the area.

Thus, I believe investors should keep an eye on the developments and try to accumulate shares possibly by setting up a limit order in order to get filled when someone would want to sell.

Past Performance And Management

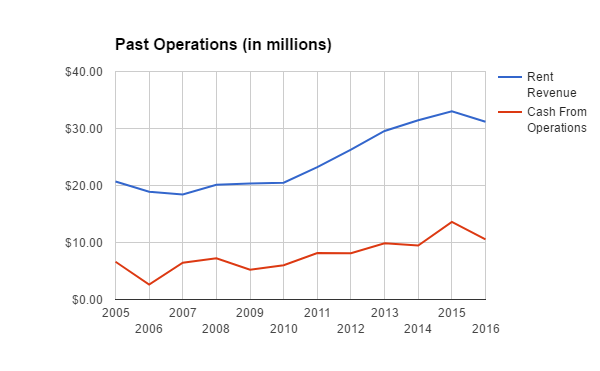

The company has been in the real estate business for some time as it started to develop several of its early properties in the 1970s. In early 1990s, the company was spun-off from Commerce Bancshares, a community bank originally focused on Missouri. Since then, Tower Properties and its management have run simple yet effective operations. They used their original properties to modestly leverage themselves through mortgages, expand their asset base and thus grow their cash flow and revenue, both of which can be seen below.

They also disposed of several of their properties throughout the past, which helped to expand the balance sheet, but the management does state that it is not buying real estate for speculative purposes and mainly want to grow the cash flow of the business. The operating costs are not overblown and seem to increase in line with revenue, and during the financial crisis, the operational results did not suffer as the properties remained mostly leased out.

All this then shows that the management is patient, conservative, and does not burn shareholder value. One could even describe it as shareholder-friendly as its disclosure is sufficient, and the family does not exert negative ‘control’ over the business.

While this is positive, there are several possible issues that could challenge the notion of the management being shareholder-friendly.

Firstly, it is the risk that the family would want to take the company private and do so at a low-balled price due to illiquidity and relatively small size of the business. It could be that it is going to try to do a tender offer when it will know that only a handful of shareholders are left and that the price is not going to be as undervalued as it is now and/or do a short-form merger once it hits 90% ownership (minority shareholders would have to appraise rights if the price is low).

Secondly, the family could also try to manipulate with the assets as they are connected to Commerce Bancshares (they sit on the board and operate several divisions), a bank that is among other things providing a credit line to TPRP, and TPRP actually owns roughly 200,000 shares of the CBSH’s stock. This is a double-edged sword for minority investors as it is positive that they can easily get financing should they need it, but the family could also be incentivized to sell the properties to the bank at undervalued prices (should it need a special dividend or so) which would be harder to contest than to appraise rights.

That being said, I believe that due to its past behavior, it is unlikely that the management would suddenly try to aggressively take out the minority shareholders. It has built its wealth mainly through the bank, and thus, TPRP is likely to be rather a stable cash flow generator for it, which could partially align the two groups of shareholders.

The family’s shareholder-friendly conduct can also be seen in its dealings with Commerce Bancshares, which is publicly listed and has been increasing shareholders value over the long-run due to efficiently run operations.

Valuation

- Asset base

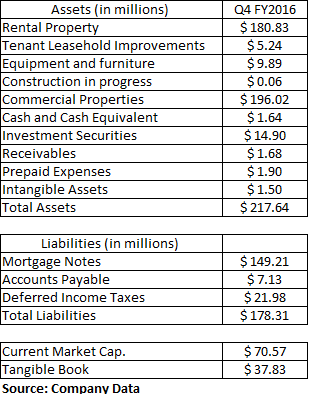

As mentioned, the main value of TPRP lies on the balance sheet seen below, as the properties are likely significantly over-depreciated.

Note #1: The mortgage notes item does not include $8 million, which would be the early prepayment liability.

Note #2: As mentioned, TPRP owns Commerce Bancshares which totals at $14.9 million. While there could be a risk connected to these securities, the community bank is operating in a conservative way and so far has been increasing its market value with minimal share price drawdown.

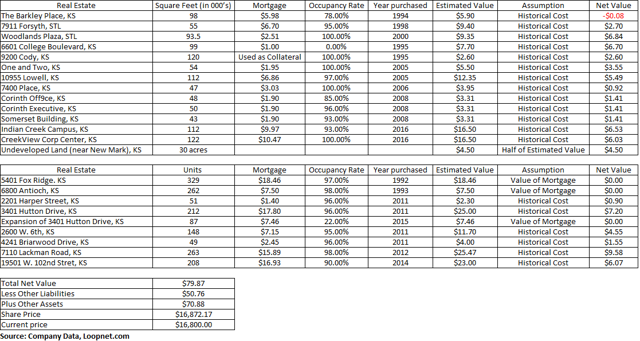

In order to try to estimate how much the real estate could be valued at, I decided to take two scenarios. First, I just assigned historical costs to the properties, which clearly showcase the over-depreciation and the strength of the margin of safety as the new tangible book value of the company matches the current market capitalization as seen below.

Note #1: The reason that 6601 College Boulevard has 0% occupancy rate is refurbishment. 9200 Cody is used as collateral for TPRP’s credit line.

Note #2: The reason behind using mortgage values for Antioch and Fox Ridge is that the historical cost for each property was around $6-7 million. This is not a realistic value, and thus, the company should be able to sell these properties at least for the value of the mortgage. In the case of the expansion of Hutton Drive, I used the mortgage cost instead of the construction cost (it just finished the property at the end of 2016) which is higher by roughly $2 million. Again, I don’t believe that the company should have an issue to sell the property for the value of the debt.

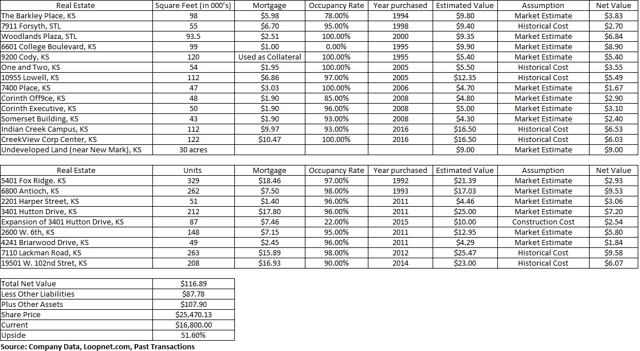

If we try to estimate a more reasonable valuation (remember that some properties are from 1990s and early 2000s, and thus, they are highly likely to be worth more than their historical cost), the asset base could point to a 51% upside as seen below.

Note #1: Value of 7911 Forsyth Plaza was estimated via historical cost as the market estimate was below that. This seemed unreasonable given the nature of the building and its location. Woodlands Plaza was estimated by using this listing of a building that is almost identical and is located right next to it. 9200 Cody was estimated by this listing, which was further supported by a 2012 transaction of a similar warehouse by TPRP. One and Two Towers were estimated by historical cost as it was near my market estimate, which seems conservative enough. 10955 Lowell was estimated via historical cost as it represents a slight premium to the official property assessment value (which you can find here) and is not far off my market estimate. The undeveloped land was estimated using this listing. Indian Creek, CreekView, 7110 Lackman and 19501 W. 102nd are all estimated via historical cost as TPRP bought these properties recently, and thus, it is unlikely that the value has changed significantly. Fox Ridge and Antioch are both estimated through the recent TPRP transaction of 632 units for $35 million in 2016. I estimated slightly higher $ per unit due to the size of both properties.

Note #2: Properties that are not mentioned in #1 are based on either $100 per SF or $87,500 per unit. These estimates are slightly discounted prices of recent TPRP transactions.

I believe that the upside could be even larger due to some of my estimates, especially the ones connected to properties such as Antioch and/or Hutton Drive, but in the end, the main takeaway point is that the company sits on valuable real estate.

- Cash Flow

The asset base thus sets up a perfect margin of safety and already points to an upside, but I believe that due to the efficiency and conservative attitude of the management, the going concern valuation could point to a bigger upside.

As mentioned in the thesis, the cash flow is likely to meaningfully increase this year due to completion of refurbishment and construction of expanded Hutton Drive. This should increase the cash flow by at least $1 million (due to the size of properties), and thus, the company could earn around $10 million in free cash flow (as CapEx usually stands about $1 million, and the FCF for 2016 was $9 million). This would mean the current market cap implies that investors would, in essence, get their money back in around five years (I adjusted the market cap for cash and investment securities). This is an enticing proposition as it is likely that the company is going be in operation well past this time frame with likely similar results, and thus, it could be that investors would be willing to pay significantly more for this cash flow stream.

At the very least, the strong cash flow again supports the notion of margin of safety.

Conclusion

I would say that TPRP resembles HMG/Courtland Properties (HMG) in a way because you are also co-investing alongside a controlling shareholder into real estate. The nature of the investment is also long term, and unlocking of the value might take time, but at the current prices, it makes sense to try to establish a position even if one should pay a slightly higher price as the asset base is attractive.

The liquidity is an issue, but as per usual, the patient investor might be able to snap TPRP at a reasonable price. I would not say that selling would be an issue as the family is likely to try to repurchase as many shares as possible.

Comment